Increasing Financial Security Through Cashly

Overview

The Problem

With financial insecurity on the rise, Cashly is a platform tailored for individuals who lack the time or expertise to budget effectively. Designed with an intuitive interface, Cashly aims to empower users by promoting financial awareness of their spending habits, helping them understand their current situation and plan for future goals

The Challenge

How might we develop a platform to help users track and better manage their finances?

Competitor Analysis

Interviews

To be able to empathize with how people operate with their finances, I conducted 12 user interviews from people with various backgrounds. I asked questions focusing on how these people handle the following financial thinking operations.

Grasping your financial overview

Budgeting for various categories

Setting short and long term financial goals

Troubles around compiling information

"I waste a lot of time trying to keep track of all my finances. I have different bank accounts, different credit card bills, to keep track of all of it is a tall task"

Troubles around budgeting

"Sometimes they make new plans, so then I just kind of forget about the original budget because how often do I get to see my friends? I know it's not a good thing in the long run"

Troubles around keeping to financial goals

"For a week I'll want a new car right? So I'll put extra money in that fund. But then that 'want' isn't the most important thing because something else popped up"

Personas

Brainstorming

After reviewing and gaining insights from the research, we moved onto iterating over the features that should be implemented into the platform. This phase included deciding the golden path for our user-flow, further addressing key pain points from our insights, and wireframing what the platform would look like, as well as deciding a color style.

Key Solution Elements from Insights:

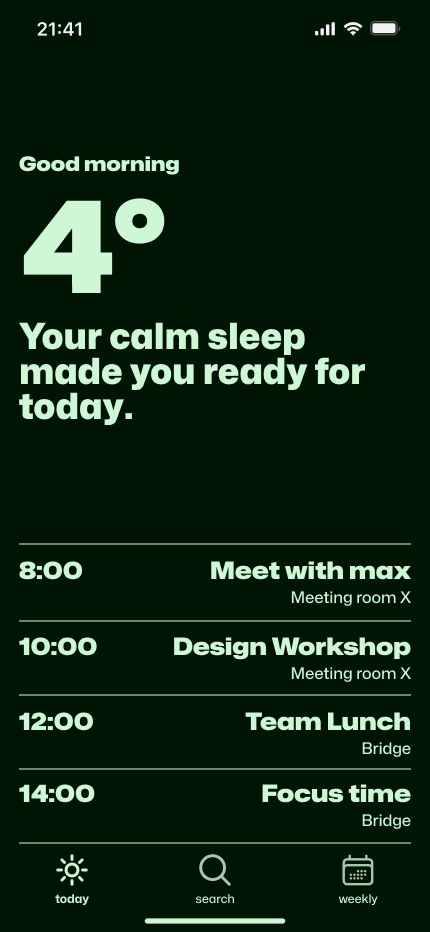

Centralized Financial Dashboard

Provide a unified platform where users can view all their accounts in one place.

Automated transaction categorization

Allow users to customize or adjust the categories

Users must be allowed to manually add charges/purchases

Users can ask the AI assistant for a quick analysis of their habit (user must opt in to this)

"The platform should still be useful even if the user does not feel comfortable linking their accounts"

Enhanced data visualization

Financial Goal Setting and Budgeting

Allow users to set financial goals and provide visual progress trackers

Users can create a total of twenty financial goals

Users can choose whether a goal is short term or long term, and receive appropriate notifications for that goal.

Users can set budgets for categories

Categories can be automated or manually added

User can choose whether the budget is weekly, monthly, or yearly.

Users can opt in to use the AI assistant to calculate numbers quickly.

Educational Resources

Users can access resources such as financial literacy guides, tips, and video tutorials directly within the platform

Provide personalized recommendations based on user spending habits or goals

How The User Navigates

Mapping out the user flow is a crucial part in the design process. The user flow refines the boundaries of the product, stating what is possible and what is currently not. Any adjustments / added features to the product would have to fit into this user flow. Some information I specifically gained from the user flow is: what screens I needed, potential pain points, and number of actions possible on any given screen. With the user flow defined, I can begin wireframing.

Wireframing MovieMate

To create a good layout of the app, I utilized Crazy Eights to get a general sense of where the buttons, text, icons, and images belong. I also asked my interviewees which aspect of each wireframe they liked the most, and tried to bring it forward into further designs to create a unique layout.

Key takeaways were:

Interviewees reacted well to the Gmail-esque filter button being located constantly in the bottom right corner.

Interviewees specifically liked the implementation of a button to show a map of the theater’s area.

Interviewees preferred a simple menu bar at the top of the screen rather than at the bottom.

Using a Style Guide

Creating a style guide was crucial in establishing a cohesive visual identity to MovieMate. A cohesive visual identity is important to a product because it establishes brand recognition, instills trust and credibility to users, and helps a product stand out from its competitors. Visual identity for MovieMate consisted of a defined typography, color palette, and iconography.

Quick & Convenient

After conducting interviews and doing research, three key features stood out to test users that would encourage them to go to the theater more.